If you are thinking about purchasing a home, there are several things you should do before you even start your home search. While it’s exciting to look at properties and imagine what your life will be like in a new house, you might be setting yourself up for disappointment and heartbreak if you aren’t prepared for all the steps involved in the home-buying process, especially now when we are in such a competitive seller’s market. So, do your homework and make sure you are truly ready so that when you find the home of your dreams, you are fully prepared to purchase it!

Determine What You Can Afford – You don’t want to find the perfect property and then find out it’s out of reach for you. Determine what amount you can afford for a mortgage payment and create a maximum budget for what you are willing to pay for a house. Your mortgage payment should take up no more than 28% of your income. If you are currently paying rent or a mortgage payment that is less than what you anticipate for your future home, start saving the difference each month to make sure you are willing and able to live on that. You don’t want to be house poor. Mortgage Calculator

Check Your Credit – You can request free credit reports from Annual Credit Report .com. Check the reports thoroughly for any errors or negative information. Take the steps needed to improve your credit score. A higher credit score will possibly qualify you for lower interest rates, which will make your purchase more affordable.

Meet with a Lender – Getting pre-approved for a mortgage is vital to the home-buying process, especially in a seller’s market where there might be bidding wars. Sellers are more likely to choose a potential buyer who has already been pre-approved over one who hasn’t. It will also help you identify the documents you will need for the final loan application.

Save for a Down Payment – Your meeting with the loan officer will also help you determine how much cash you will need for a down payment.

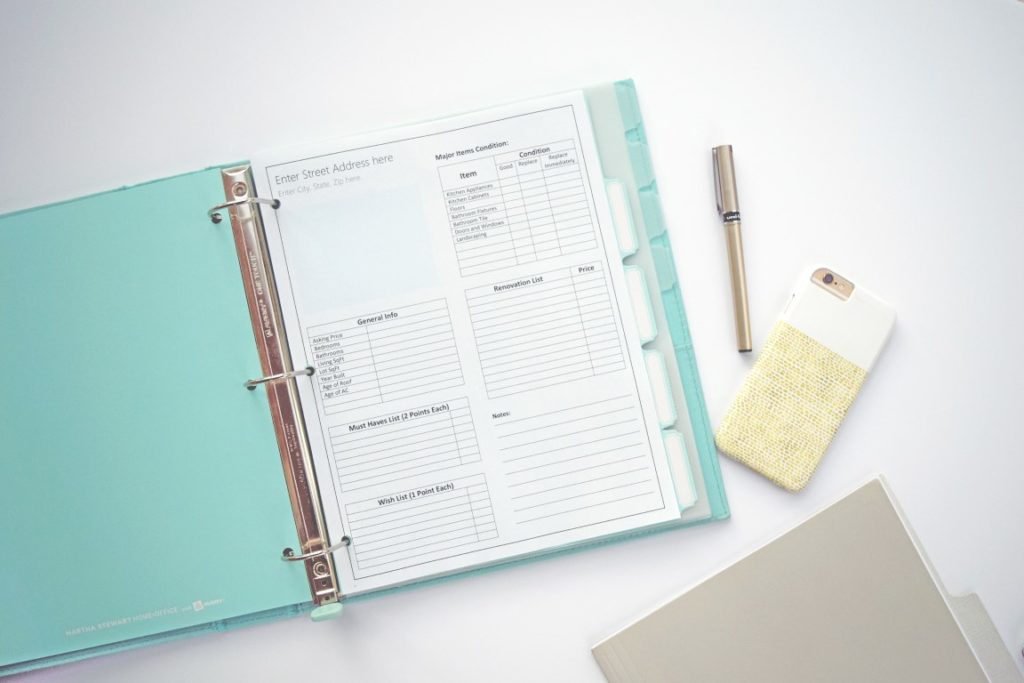

Get Organized – Gather documents you will need for your final loan application and start a house-hunting binder. As you start looking at homes, you can add any materials you collect along the way. House Hunting Binder

Start Considering Where You Want to Live – If you don’t already have a specific neighborhood in mind, start investigating different areas within your price range. Visit neighborhoods at different times to get a feel for what it might be like to live there. Consider things like what your work commute will be and what amenities you want.

Take a Homebuyer Education Class – If you are a first-time homebuyer, these classes can help you prepare for the responsibilities of being a home owner.

Find a Realtor – Choose an experienced Real Estate Professional to represent your interests. It’s important to find someone you feel comfortable communicating with.

Taking these steps before you start your home-search will make the whole home-buying process easier!

Are you thinking of buying a home or selling your current home in New River Valley, VA? Then it is time to contact Desi Sowers, your New River Valley, VA real estate resource! Give her a call today at 540-320-1328!

Photo Credits: centralwcu.org, forbes.com, simplysianne.com